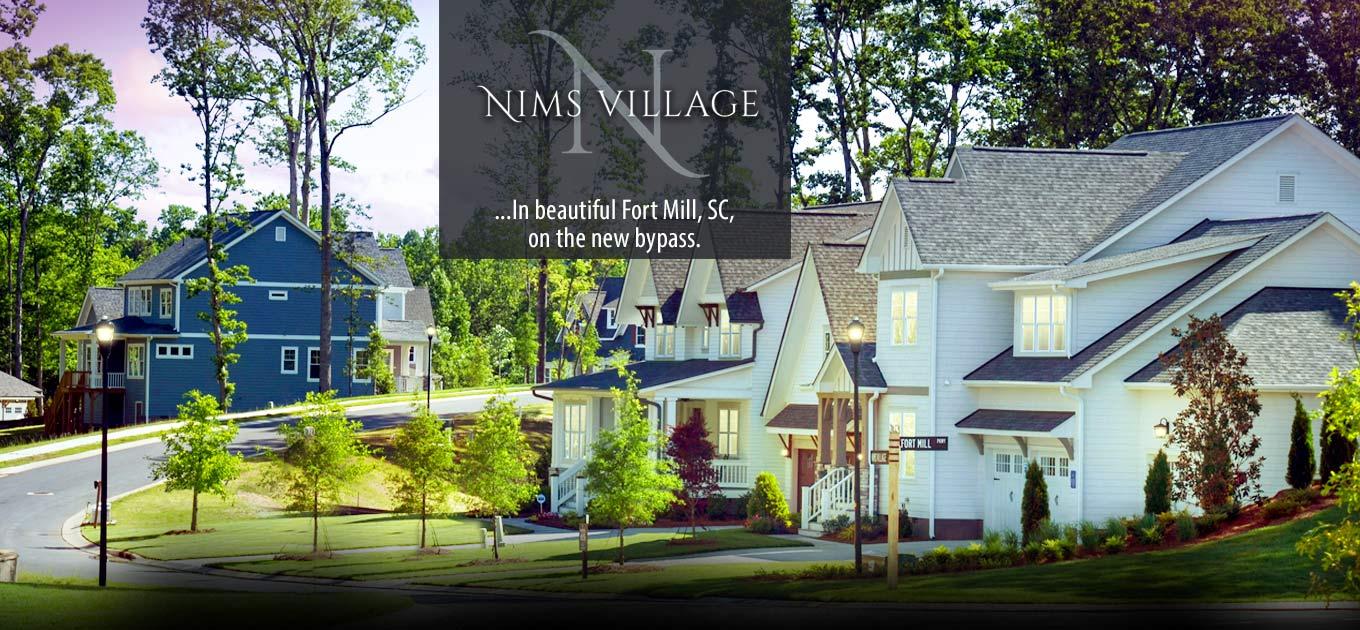

Evans Coghill Homes is a Charlotte, NC new home builder, building new homes in Cheval, McLean, Belmont, NC and Nims Village, Riverwalk, Springfield, and Ft Mill, SC. For information on these new home communities and our available homes, visit www.EvansCoghill.com.

Increased Loan Limits Are Great For Buyers and Builders!

The Housing and Economic Recovery Act (HERA) of 2008 requires that the baseline conforming loan limit be adjusted each year to reflect the change in the average U.S. home price. To keep up with soaring home prices, the 2018 FHFA limits on home loans have risen considerably (6.8%!), with standard mortgage limits increasing to $453,100 in most parts of the country, and FHA mortgage limits having a $294,515 maximum for single-family homes. (More information can be found in a recent article by Professional Warranty Service Corporation.)

The Housing and Economic Recovery Act (HERA) of 2008 requires that the baseline conforming loan limit be adjusted each year to reflect the change in the average U.S. home price. To keep up with soaring home prices, the 2018 FHFA limits on home loans have risen considerably (6.8%!), with standard mortgage limits increasing to $453,100 in most parts of the country, and FHA mortgage limits having a $294,515 maximum for single-family homes. (More information can be found in a recent article by Professional Warranty Service Corporation.)

For home buyers, the increase means no more restrictive and expensive jumbo loans. It also means more first-time buyers will be able to purchase homes with as little as 3.5 percent down. “These loan limit increases can help buyers save money when getting a mortgage, improving the opportunity for everyone, especially first-time home buyers, to get into that new home,” says Forbes contributor Christina Boyle, senior vice president and head of Single-Family Sales and Relationship Management for Freddie Mac.

For home builders, like Evans Coghill Homes, the hike in loan limits opens up a wider potential customer base as more prospective buyers are able to qualify for affordable loans. For example, buyers will be able to:

- Afford a newly built home. The new lending limits are likely to entice more buyers to enter the market — and make newly built homes affordable for more people. View our available homes to find a newly built home perfect for you!

- Purchase larger homes. The new lending limits give qualifying buyers up to $30,000 worth of extra breathing room. As a result, buyers may be able to purchase larger homes in more expensive neighborhoods. We’re thinking homes in our Cheval and Springfield neighborhoods!

- Qualify more easily. Higher mortgage limits will make it easier for buyers to qualify for a home loan. Compared to jumbo loans, a standard mortgage offers less stringent credit requirements, lower down payment options, and lower debt-to-income requirements.

- Put less money down. First-time buyers often rely on FHA loans to afford a home since the lower credit requirements and minimum down payment help remove some of the barriers to homeownership. With higher loan limits, first-time buyers can buy pricier homes while still qualifying for an FHA loan.

- Save thousands of dollars.

Jumbo loans often have higher interest rates and closing costs than traditional mortgages. The ability to finance a home without a jumbo mortgage can save buyers thousands of dollars over the life of the loan.

Jumbo loans often have higher interest rates and closing costs than traditional mortgages. The ability to finance a home without a jumbo mortgage can save buyers thousands of dollars over the life of the loan.

The rise in loan limits makes home ownership more affordable for more people, and doesn’t everyone deserve the American dream of owning a home? Evans Coghill Homes supports homeownership and would be honored to make that dream come true for you.